- Buying for personal use, rather than to let, common for Japanese

- Asian investors in particular finding Tokyo market attractive

- Good yields possible by using flats as hotel accommodation

In the UK, finances permitting, most people would buy a building or complex of flats for investment, rather than for personal use. That, however, is not the case in Japan. In Tokyo, flats of about 70m2, with a price often exceeding ¥70mn, are in great demand.

Besides those who might let the space for use as offices, property purchasers are not likely to rent for the purposes of investment. Their capital return, if any, therefore is limited generally to the cash they receive on selling the property. Even so, many Japanese tend to use that capital to purchase another long-term home.

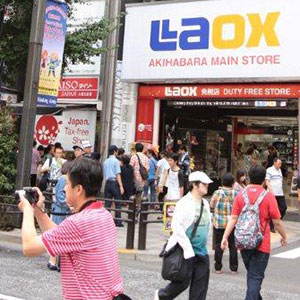

The central Tokyo market for flats, particularly around Tokyo Bay, is competitive and attracting the interest of Japanese as well as foreign high-net-worth individuals (HNWI), especially from other Asian countries. Since these HNWI do not consider the property as a long-term home, they pay a high price and expect to make a profit when they eventually sell the property.

Moreover, not only are the prices of these Tokyo flats lower than those of high-grade flats in Hong Kong and Singapore, but HNWI are attracted by the yen’s depreciation as the government targets inflation, and the economy is expected to pick up ahead of the Tokyo 2020 Olympic and Paralympic Games.

Remarkably, HNWI from other Asian countries seem not to focus on possible returns from rental income. Even though they purchase property solely for the purpose of investment, some investors believe that letting the property would damage its future value, and that a unit should remain vacant to ensure its good condition.

Even considering the rapid yield compression over the past two or three years, in central Tokyo the current average net yield for investments in rental flat complexes is 4–4.5%. By comparison, the net yield generally would be under 4%—or even under 3%—for the affordable letting of individual flats.

Domestic investors, meanwhile, tend to seek income gains and stability from rental revenue, rather than future capital gains, when they buy real estate, including flat complexes. A low net yield is the reason such flats in central Tokyo are not a popular investment option for domestic investors, although they are for HNWI from other Asian countries.

Tourism impact

While there is a low net yield from the central Tokyo market for flats, profits can be expected from investing in flats for use as hotel accommodation. This may be possible in Japan if the relevant regulations are met, and permissions and neighbourhood consensus are obtained.

Investors, boosted by the increasing number of foreign tourists, are therefore eyeing hotel properties. The hotel business is recovering well, in Tokyo as well as in most of Japan’s major cities. The average daily occupancy rate currently in both Tokyo and Osaka’s hotels is said to be more than 80%. In addition, besides the more numerous tourists, their longer stays also are helping rejuvenate the hotel business.

Particularly interesting is the fact that investors can expect a high net yield on investment in flats for hotel use in locations outside these two main urban centres.

In the past, with the Japanese mostly preferring short, domestic trips, investment was not a motivation for people to buy flats in resort areas. Rather, they used the flats themselves or for friends and relatives. Now, however, the Japanese are increasingly realising that these flats could see greater occupancy were they let to the growing number of foreign tourists.

On Airbnb websites, accommodation in famous resort areas has an expected monthly revenue similar to that in central Tokyo. While depopulation is the main threat to investment in residential properties outside Tokyo, hotel flats would not face this issue—unless the number of tourists falls. In fact, in some regions, flats are undervalued if one considers the return on investment were they used for tourists.

Thus, were an area’s initial investment cost one-tenth that of Tokyo, and the revenue return half that of Tokyo, it would be considered a good investment. The net yield would easily exceed 5%, even considering the cost—management contract—of operating flats as a hotel. In this market, domestic investors and HNWI from other Asian countries eye the investment property similarly.