The ambassador’s residence at the British Embassy Tokyo is no stranger to hosting trade events, but at the UK Fintech Night in Tokyo on the evening of 21 September, the atmosphere was noticeably different from usual. Although not fully embracing the tech entrepreneur uniform of hoodies, T-shirts and trainers that has spread from Silicon Valley in the United States to London’s Silicon Roundabout and beyond, the less formal attire of many guests and the more relaxed air signalled that this was a different crowd.

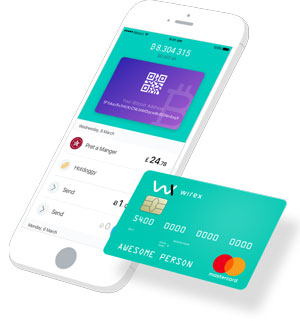

Wirex, a bitcoin wallet and debit card firm, was one of the startups making a pitch.

This was capped off by a pitch session featuring nine UK firms, among them Finantix Limited, Miracl Limited and Ohalo Limited, operating in or connected to the fintech space.

Adding to the tech flavour of the event, Michael Harte, head of group innovation at Barclays Bank PLC, addressed the topics of data and innovation. Quoting the Canadian science fiction author William Gibson, he said, “The future is already here—it’s just not very evenly distributed”.

“There is a very, very big shift away from the old closed systems where data was pooled—this is now giving the power of algorithms and the power of aggregated data to you, the consumer”, he said.

On the same note, consumers are becoming increasingly empowered and demanding products and services that work on their terms, he said, citing the growing adoption of Internet ad-blocking software as an example of this. That, in turn, is having an impact on the world of finance.

“If financial services and fintech firms alike are going to be relevant, convenient and valuable to their consumers, they have to make life even better for the consumer”.

Returning to the earlier Gibson quotation, he then pointed to Tencent Holdings Limited’s WeChat app in China as an example of this. Ostensibly a messaging app, the platform also allows users to transfer money, pay bills, book tickets and taxis, make appointments, shop and much more.

“And guess where banking is? Hidden and in the background. Simplified in one page with no advertising”, he said.

“So at Barclays, we’ve got a really hard job. Over 325 years of history living in closed systems, pooling our data, using our algorithms for us, not for the consumer. Having to open up, having to compete with big tech, fintech and to open up and be relevant and valuable in real time for each and every customer that no longer wants a generic product”.

At the forefront

Following introductory remarks by the British Ambassador to Japan Paul Madden CMG, the UK’s Minister for Digital Matt Hancock took to the stage to outline the future of the British fintech sector and the government’s approach to it.

Matt Hancock, minister of state for digital

“The digital revolution that we are living through is, of course, a global phenomenon. But I believe that the UK and Japan stand at the forefront of considering where these changes can take us, and how best we can equip ourselves for the future and harness the opportunities”, said Hancock, pointing to the digital strategies that both countries have formulated.

Turning to fintech specifically, he noted that London, due to its significant role as a financial centre, has already helped incubate a number of world-leading fintech firms, such as Finastra Group Holdings Limited and Markit Group Limited. Such businesses are adding to the economic strength of the UK.

“At a time when automation is replacing existing jobs, fintech is supplying new skilled positions, and plenty of them—over 60,000 people in the UK now work in the industry, which is currently worth £7bn to our economy. And domestic demand for fintech is strong, both in terms of bank to bank and bank to customer markets”, he said.

New waters

Outlining the government’s priorities for the fintech sector, Hancock said that they would work to maintain and protect the open flow of data, support cyber security and a data protection framework, and ensure that financial regulations are open to innovation. On that matter, he pointed to the attitude of the UK’s regulator, the Financial Conduct Authority (FCA), particularly its Project Innovate initiative.

As part of that, in 2015 the FCA introduced a so-called regulatory sandbox, giving firms a chance to test new products and services in the real market on a small scale in a closely monitored environment.

“The FCA was the first regulator in the world to do this, but by no means the last, because it’s a model that is being replicated both by other financial regulators around the world and by regulators of other sectors”, Hancock continued. “We are happy about that, not just because imitation is flattery—although we are glad to accept the compliment—but because we’re all entering these new waters together. The technology knows no boundaries”.

Across the board

Asked later in the evening by BCCJ ACUMEN about the government’s approach to data protection when it comes to fintech and possible points of collaboration with Japan in this area, Hancock replied, “I think that the unhindered flow of data between the UK and Japan is very important, and I hope that we can see that unhindered flow of data properly protected between the UK and the EU and Japan—and indeed the United States.

“That is what we seek in our negotiations with the European Union, but also in the European Union’s negotiations with Japan, so I think there’s a good opportunity to get this right.

“Of course, unhindered flow of data requires good cyber security and good data protection, but all of these things are increasingly coming into place. So I’m quite optimistic about having a good data environment internationally”.

One of the main finance stories in 2017 has been the strong rise in the value of bitcoin, which has seen a sustained rally through much of the year and surged past the $5,000 mark in October. But the rise of bitcoin and other crypto currencies—digital assets used as a medium of exchange and secured by cryptography—has raised questions about how governments should respond.

“We’re open to bitcoin and other, similar currencies in the UK”, Hancock said.

“We think that they’ve got a role to play. We think that it’s better to have transactions onshore and, because bitcoin and crypto currencies will exist anyway, we think there are advantages [to that]”, he added, noting that this ties into London’s existing role as a market for several international currencies.

“What’s more, because of the nature of the blockchain, actually following the money through bitcoin is easier in many ways than through a traditional national currency”.

Asked where he had seen any strong opportunities for British firms in Japan, Hancock replied that he had that very evening.

“I literally saw for myself people coming off the stage and being approached for investments and future partnerships”, he said. “I think that’s a great role that the embassy and the government can play in bringing people together, and so I think that’s been really successful.

“In terms of opportunities, I think there are opportunities across the board. The fintech industry is growing fast, and it’s growing as fast as people can come up with new ideas to make financial products better than they have been in the past”.

Toshio Taki (left), head of fintech research and board member of Money Forward, Inc., and Pavel Matveev, chief executive officer of Wirex Limited

Before the stage was handed over to the fintech firms making pitches, a panel discussion between entrepreneurs in the sector moderated by Toshio Taki, head of fintech research and board member of Money Forward, Inc., expanded on the challenges faced by UK businesses in Japan, and vice versa.

Pavel Matveev, chief executive officer of Wirex Limited, a bitcoin wallet and debit card firm, pointed out that one of the key challenges for his firm was adapting what is an international product to the specifics of the Japanese market.

“There is a different regulatory regime on the ground, so we had to change and adapt our product for the Japanese market”, he said.

“I have to say that we have been receiving a lot of support from the UK government, from the [Department for International Trade], from [the Japan External Trade Organization]; there are different programmes from the Tokyo government as well. So it’s not actually that hard to start doing business in Japan, to enter this market, especially if you’re a fintech company”.

Matveev also mentioned the importance of finding the right partner, a point echoed by Hamish Anderson, chief executive officer of MoneyMovr Limited, a platform for international payments by medium-sized enterprises.

Hamish Anderson, chief executive officer of MoneyMovr Limited

Asked by Taki what such a partner would look like, Anderson replied, “The ideal partner for us solves problems that we don’t probably solve in the business already.

“What we would need is access to customers: so small businesses, high-net worth individuals who could benefit from the products and services and approach that we take to international clearance. And also a partner who can help us make introductions to the banking network that we would need in order to adapt and develop our service to provide the highest-quality experience for customers here.

“There are numerous potential partners that fit that profile”, he added.

Ryota Hayashi (left), co-founder and group chief executive officer of Finatext Ltd., and Yuzo Kano, co-founder and chief executive officer of bitFlyer, Inc.

For Japanese firms going in the other direction, there are additional considerations to bear in mind as well.

“The biggest challenge is that there are no Japanese firms, except for [bitFlyer, Inc.], trying to go global”, said Ryota Hayashi, co-founder and group chief executive officer of Finatext Ltd., a data analytics provider and mobile app developer. “If you try to go global, people will look at you as if you’re stupid, because it’s absolutely, near-term wise, a lot more sensible to do business only in Japan or with Japanese firms.

“The challenge for me is that I have no people to talk with—there are so many UK firms coming to Japan, so people share what the challenge is like. I can probably only find [bitFlyer co-founder and chief executive officer Yuzo Kano, a fellow panellist] to discuss that with, but he’s going to the United States”.

Similar to Matveev’s point about adaptation, Hayashi noted that Japanese firms face their own challenge in this respect.

“Many Japanese products are so Japan-specific, especially retail products, that it’s really hard to adjust into the Western world”, he said. “I think the entry barriers for [UK businesses] are slightly higher, but the adaptation barrier is lower.

“In our case, the entry barrier is lower because there are so many big firms in the UK and there is the support of the government. But, if I want to adapt my Japanese product to the Western world, that’s a huge challenge because I get used to the very specific Japanese customer behaviours”.

Taki then raised the question of human resources, asking the panel about challenges when it comes to hiring.

“It’s a challenge, specifically here in Japan, to find people with a fintech background, because fintech is relatively small here”, Matveev replied. “The pool of candidates here is not that big”.

He added that a further challenge comes from finding someone suitable for a startup culture, which is greatly different from that of a large firm.

“We decided that we need to start at the top and hire a Japan chief executive officer, and we were looking specifically for somebody with a fintech background, with a startup background. And, lucky for us, we managed to find a very good candidate”.