Innovation in cell and gene therapies, as well as ribonucleic acid (RNA) platforms, originating in the Asia–Pacific region has garnered international recognition. This includes the seminal discovery in 2007 of induced pluripotent stem cells—an achievement for which Shinya Yamanaka and Sir John Gurdon shared the 2012 Nobel Prize for Physiology or Medicine.

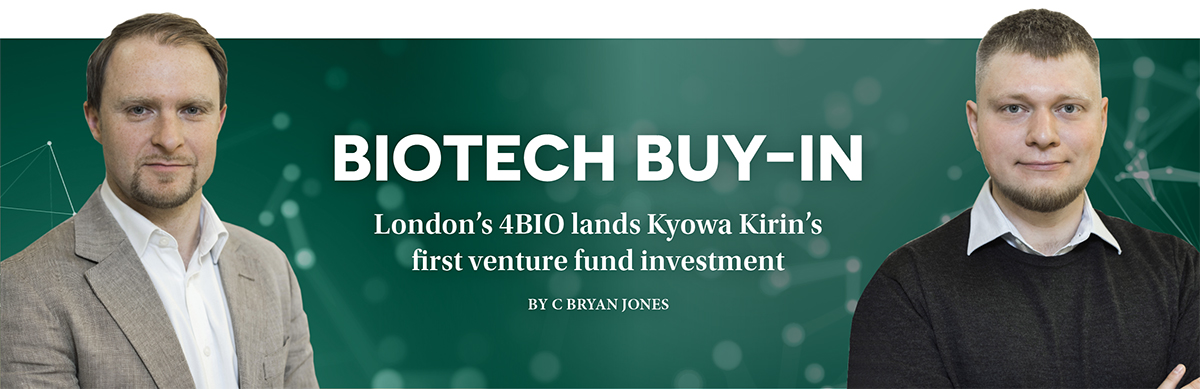

Japan’s scientific prowess makes it a potential powerhouse in the field of advanced medicines, but the country is often overlooked by global investors. London-based 4BIO Capital is looking to change that. Established in 2014, the international venture capital firm focuses solely on the advanced therapies sector with the objective of investing in, supporting and growing early-stage firms that develop treatments in areas of high unmet medical need. The ultimate goal is to ensure access to these potentially curative therapies for all patients.

Invest and advance

Specifically, 4BIO looks for viable, high-quality opportunities in cell and gene therapy, ribonucleic acid-based therapy, targeted therapies and the microbiome. Advanced treatments, including modalities such as cell and gene therapy, have the potential to cure chronic disease and eliminate the need for lifelong, sub-optimal and expensive treatments.

In fact, RNA technology is playing a critical role in the current global health crisis, as some of the authorised vaccines are based on it. Instead of using a weak or inactive form of a virus to trigger an immune response, RNA vaccines use the virus’s genetic code against it.

Advanced biotherapeutics are key to addressing the challenges of modern-day healthcare, such as the spiralling cost of long-term chronic illness and a lack of cures, and present a significant investment and impact opportunity.

The 4BIO Ventures II LP Fund’s first close was completed in September 2019, with more than $50mn committed, and the final close goal is $100mn. Through the fund, 4BIO will invest in eight to 12 private firms around the world.

Japan and beyond

Last June, Kyowa Kirin Co., Ltd. announced a commitment of up to $10mn. It was the first investment into a venture capital fund for the Japanese pharmaceutical and biotech firm, headquartered in Tokyo.

The investment will provide Kyowa Kirin with access to the advanced therapies space across the UK, Europe and the United States through 4BIO’s investment team. 4BIO will gain access to Kyowa Kirin’s scientific and R&D teams to better inform its ongoing investment in the space.

“4BIO’s Ventures II fund, and its sole focus on advanced therapies, gives us a fantastic opportunity to support early-stage companies in what we believe is the fastest-growing and most important field of medicine”, said Kyowa Kirin Executive Officer and Director of Corporate Strategy & Planning Takeyoshi Yamashita. “We share 4BIO’s vision of ensuring sustainable access to potentially curative therapies for all patients and contributing to the health and well-being of people around the world. This investment underlines our shared ambition to do so”.

The collaboration is a big step towards 4BIO’s goals in Japan, which partner Kieran Mudryy says is to nurture innovation. “There is a lack of access to early and seed funding in Japan. In the UK and US, in particular, the idea of incubators and access to early grant money from universities and local governments is really established. In Japan, that all exists, but it’s tiny compared with elsewhere. We believe that, by building up a network with other funds, we can spot opportunities early enough and be the early risk-takers”.

Local experience

Assisting 4BIO with connections in Japan is Philippe Fauchet OBE, the former president and representative director of GlaxoSmithKline K.K., who went on to serve as chair from April 2017 to February 2019. He is also a past member of the British Chamber of Commerce in Japan Executive Committee. Fauchet joined 4BIO as a Japan-based venture partner in September 2019.

“Japanese companies are difficult to penetrate. They try to maintain a kind of ecosystem where they collaborate within their own networks”, Fauchet said. “So, we must recognise this very courageous decision that Kyowa Kirin took to make an alliance with a rather young organisation. 4BIO is not a BlackRock or any one of those big names that everybody knows. It’s a young fund that is focusing on very advanced therapies”.

But this pursuit of things that are not the primary focus of other funds is a unique characteristic of 4BIO, he added, and one that Kyowa Kirin found attractive.

“They saw the benefits—the fact that there is big experience available inside the company and in the UK, even the capacity of 4BIO to provide some training, if needed, to collaborators from Kyowa Kirin”, Fauchet explained. “Trust has been based on those various ingredients, and also because the 4BIO team came regularly to Japan to explore and visit, to get know each other”.

Govt help

The original groundwork for the collaboration between 4BIO and Kyowa Kirin was laid by the British Embassy Tokyo. As 4BIO Managing Partner Dima Kuzmin explained: “This is actually another excellent example of the UK government’s support. We met Kyowa Kirin before we met Philippe, and that was through the efforts of the British Embassy Tokyo and the Department for International Trade, who introduced us to Philippe as well. We’re incredibly thankful to them for that.

“This is one of the largest Japanese direct investments in the UK-based venture capital life sciences funds and a substantial participation of Japanese strategic involvement in a fund that builds new companies in the UK. We think that’s really important”.