Country executive for the Royal Bank of Scotland Japan

Founded in Edinburgh in 1727, the Royal Bank of Scotland (RBS) has over 140,000 employees and serves about 30mn customers in 38 countries. In the third quarter of 2012, RBS reported a core operating profit of £1.633bn, up from £980mn the previous year.

RBS started its Tokyo operation and introduced its distinctive logo in 2001, after having acquired the National Westminster (NatWest) Bank Group in 2000 and the business of the NatWest Tokyo Branch that had opened in Tokyo in 1971.

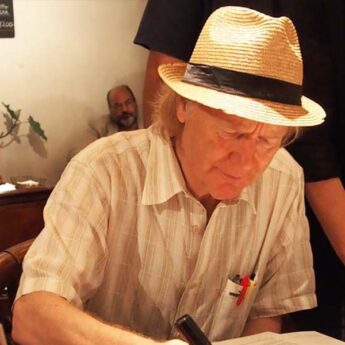

Ernie Olsen, the country executive for RBS Japan since February 2010, has overseen the institution’s recovery in the Japanese market in the aftermath of the global financial crisis that commenced in 2007.

What services does RBS provide in Japan?

We focus on our core strengths—international debt financing, transaction services, risk management— where we maintain market-leading positions globally.

Throughout our worldwide network, we raise capital for companies; manage risks; and move money through our transaction services—the three key areas for banks and securities companies.

We are typically in the top five in the global league tables in all three categories, which is important for what it says about our clients. They choose to bank with RBS, which is what has put us in these leading positions. These scorecards show how well we are serving our clients’ needs.

How have your operations changed in the time you have headed RBS here?

Since the onset of the global financial crisis, our primary role has been restructuring. This has meant strengthening our balance sheet, reducing our operating cost base and rationalising our services.

What we have achieved has made us a very different proposition now. We are ahead of the targets that were spelt out in our restructuring plan and I feel very positive that we are going into 2013 in a very good position and will be able to serve our clients better.

How would you characterise the state of the Japanese economy at present?

A lot of attention has been focused on Japan’s “lost decades”, but I don’t think most Japanese would agree that this has been the case.

People around the country have homes, jobs, health care, education and entertainment. The cost of living is coming down. People have choices when it comes to food, music, art and travel, and corporate R&D expenditures remain substantial.

And for RBS here?

People often correlate success with economic growth, but this is a Western concept and is not necessarily shared by the Japanese.

We do not expect to see huge economic growth in Japan for a number of reasons, including the demographic situation. Thus, we were cautious in our review of strategic priorities for our wholesale banking business in light of the changing regulatory environment and deterioration in market conditions.

We focused on the areas where we are strong and scaled back in business where we do not believe we have a competitive position.

We have many clients who are now investing outside Japan. This tells me companies here understand that Japan is not going to grow and they need to go offshore.

This is perfect for us as we have a network of operations in 38 countries and can work with Japanese clients in the three core areas.

On the securities side, Japan is still the second-wealthiest country in the world, with some $39trn in national wealth.

It is vitally important for us to have a strong sales and trading business here and to link that with the other 38 countries where we operate. International banks have to focus on the value proposition of their global network.

How is the RBS restructuring effort progressing?

As shown in our recent results, our programme continues to make excellent progress as we take the action needed to make the bank safer and stronger.

It’s similar to going on a diet, but we still have a few pounds to shed. The end is in sight and that is reflected in a variety of things, including our share price. Internally we’re seeing positive signs in terms of staff morale. The focus now is on looking ahead, identifying opportunities and how we can take advantage of them.

We are creating a safe and sustainable business that serves our clients well, and look forward to making sure we continue to do so.

How can you help firms looking to enter the Japanese market?

Initially, it’s about trying to understand who our clients are and trying to meet their needs.

These firms are typically already on top of their own business, so often we can best serve them by introducing them to a local partner or business opportunity.

We can also help when it comes to things like financing acquisitions—which can be very complicated to put together—and are able to do some things that Japanese banks simply can’t do well.

What we cannot do is lend less expensively than a Japanese bank, so we do not try to compete in that space.

However, when a company is looking for services like financing for imports or foreign exchange services, our systems are better.

What changes would you like to see in the banking sector in Japan and how would they benefit clients and the economy?

I’ve been working in financial services in Japan for 26 years, giving me a long-term perspective. If the government implemented changes, it would be able to attract firms back to Tokyo.

In recent years, we have lost out to Hong Kong and Singapore, but that could be reversed.

There are lots of reasons firms are moving out of Tokyo, but the key one is that banks find it hard to run a profitable business here. This is partly due to competition that drives uneconomic pricing in many areas.

I believe that things will improve over time, including the regulatory framework. There would be multiple benefits and, if it happened, it would completely change the complexion of Japan as an international financial centre.

Our international corporate banking franchise enables us to establish long-term client partnerships through our ability to clearly understand customer needs and to translate these into smart solutions.

We are focusing on our product strengths in the Japanese markets where there are big opportunities for growth.

Over 30 key Japanese clients attended a Royal Bank of Scotland (RBS) event, designed to emphasise the importance of innovative thinking, entitled “Japan & Europe: The Future”.

At the November occasion held in London, the bank’s economists, cash and trade specialists, and currency strategists delivered a series of presentations devised to provide thought leadership on a wide array of topical subjects.

In addition, Timon Screech, a professor of History of Art at the London School of Oriental and African Studies, University of London, spoke on “The Birth of Western-style Painting in Japan”. This presentation emphasised one of RBS’ key messages of collaboration and working in partnership across borders.